Product Recall Decisions and the CEO - Informed Trading in the Medical Device Industry

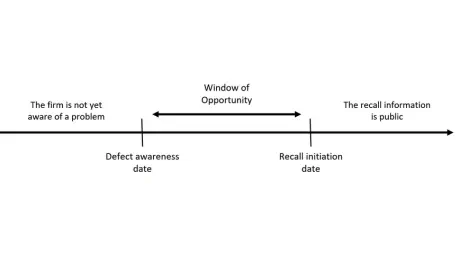

In this essay, we investigate the well-known accounting misconduct of informed trading, which refers to corporate insiders trading stocks based on private information, in the context of product recalls. The product recall process provides an opportunity for informed trading because there is a long time window between a firm becoming aware of a product defect and initiating the recall. This provides CEOs, who are aware of most recall decision processes, with an opportunity to sell their stock to avoid the financial losses incurred from the stock market penalty that follows a product recall.

To test whether CEOs exploit this “Window of Opportunity”, we combine data about recalls, customer complaints, firm finances, stock price information, and executives’ stock trades for publicly traded U.S. medical device manufacturers from 2003 to 2020. We then use firm-day fixed regression analysis to compare CEO selling activity on trading days during the “Window of Opportunity” with their selling activity on other days around the “Window of Opportunity” for Class I recalls, conditional on the presence of prior complaints. The results indicate that CEOs are twice as likely to sell their stock during “Window of Opportunity” for Class I recalls without prior complaints and that doing so helps them avoid financial losses of up to 20%. This finding presents the first evidence of informed trading in an operational context and suggests that closer collaboration between the FDA and SEC could be key to detecting and preventing such insider trading activities. Both agencies have shown great interest in the findings.